In today’s dynamic market landscape, certain stocks have captured the spotlight, driving significant investor interest and market activity. On the UK financial scene, trending tickers such as Nvidia, Trump Media, Moderna, Ocado, and JD Sports have emerged as key focal points, reflecting shifts across technology, healthcare, retail, and media sectors. This article delves into the latest movements and underlying factors propelling these companies into the spotlight on uk.finance.yahoo.com, offering insights into what investors should watch in the days ahead.

Trending Tickers Spotlight Nvidia’s Market Momentum and Innovation Drive

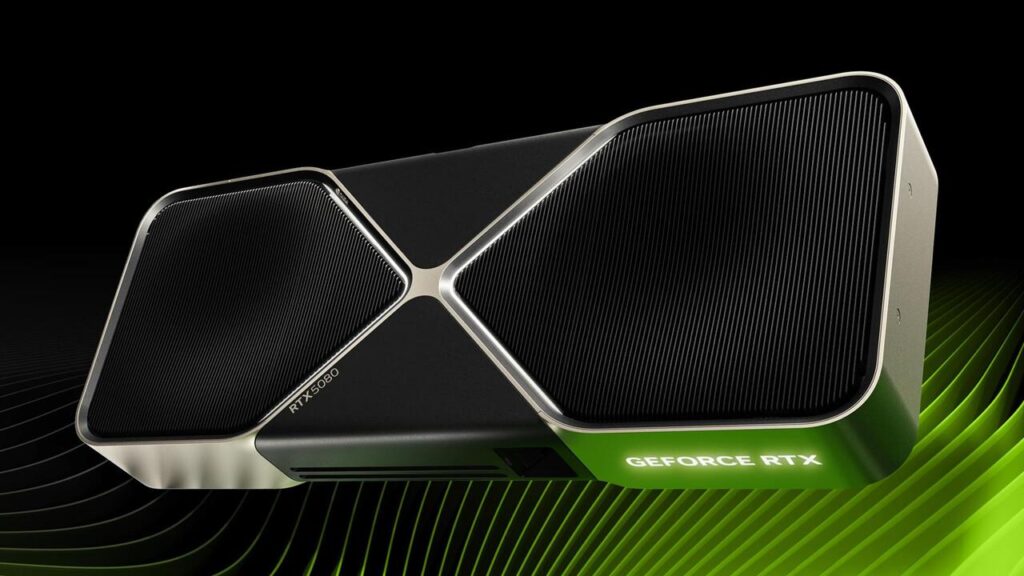

Nvidia continues to captivate investors with its impressive market momentum, driven largely by its advancements in AI technology and chip innovation. The semiconductor giant has seen a substantial rise in its stock value amid surging demand for graphics processing units (GPUs) across gaming, data centers, and automotive sectors. This upward trajectory is underpinned by Nvidia’s strategic investments in cutting-edge solutions such as its latest AI-powered GPUs and expansion into cloud computing services, positioning the company as an essential player in the tech landscape.

Key factors contributing to Nvidia’s robust performance include:

- Breakthroughs in artificial intelligence and machine learning applications

- Growing partnerships with cloud service providers

- Expansion into autonomous vehicle technology

- Strong quarterly earnings exceeding analyst expectations

| Metric | Q1 2024 | Q4 2023 |

|---|---|---|

| Revenue | $8.3B | $7.6B |

| Net Income | $2.1B | $1.8B |

| Stock Price Growth | +15% | +10% |

Trump Media’s Surge Raises Questions About Regulatory and Financial Risks

The recent uptick in Trump Media’s stock price has sparked notable interest among investors, but it has also raised several regulatory and financial concerns. Analysts caution that while the platform shows promise in capitalizing on digital media trends, its association with politically charged content could invite heightened scrutiny from federal regulators. This potential for increased oversight adds an element of risk that investors should weigh carefully.

Financially, Trump Media faces challenges that extend beyond market volatility. The company’s aggressive expansion strategy requires sustained capital, which might strain its liquidity position given the uncertain advertising revenue streams. Below is a summary of some key risk factors impacting the firm:

| Risk Factor | Description |

|---|---|

| Regulatory Scrutiny | Potential investigations or restrictions related to content policies |

| Revenue Stability | Reliance on advertising from politically aligned businesses |

| Capital Requirements | Need for continuous funding to support rapid growth |

| Market Perception | Volatility driven by political developments and public sentiment |

Moderna’s Vaccine Developments Influence Investor Confidence and Future Outlook

Moderna’s ongoing advancements in vaccine technology have sparked a notable surge in investor confidence, reflecting optimism about the company’s long-term growth potential. Recent announcements on booster developments and new variant-targeted formulations have positioned the biotech firm as a key player in the evolving pharmaceutical landscape. Market analysts highlight that these developments could drive revenue diversification beyond Covid-19, with potential expansions into *influenza* and *respiratory syncytial virus* (RSV) vaccines. As a result, Moderna’s stock has experienced increased trading volume and price gains, signaling heightened market appetite for biotech innovation.

Key factors influencing Moderna’s bullish outlook include:

- Pipeline diversification: Early clinical trials for vaccines targeting various infectious diseases.

- Strong cash reserves: Providing financial stability to fund future research and development.

- Strategic partnerships: Collaborations aimed at accelerating global vaccine distribution.

| Vaccine Target | Development Stage | Market Potential |

|---|---|---|

| Covid-19 Boosters | Approved / Widely Distributed | High |

| Influenza | Phase 2 Trials | Moderate to High |

| RSV | Phase 1 Trials | Emerging |

Ocado and JD Sports Navigate E-commerce Growth Amid Competitive Retail Landscape

Ocado continues to leverage its advanced technology platform to boost online grocery sales, focusing on expanding partnerships and enhancing supply chain efficiency. Despite a saturated market, the company’s proprietary automation and AI-based solutions have positioned it as a key player in reshaping grocery e-commerce. Investors are closely watching Ocado’s strategic collaborations and tech rollouts, which aim to drive sustainable growth amid rising competition from traditional supermarkets expanding their digital offerings.

Meanwhile, JD Sports is navigating the retail landscape by strengthening its omnichannel presence and capitalizing on the increasing demand for athleisure wear. The retailer’s focus on exclusive product lines, loyalty programs, and digital innovation are central to maintaining market share in a highly competitive environment. With evolving consumer habits and continued investment in online infrastructure, JD Sports is reinforcing its position to capture a larger share of the booming sportswear market.

- Ocado: Technology-driven efficiency and partnership growth

- JD Sports: Omnichannel expansion and exclusive brand offerings

- Market dynamics: Rising consumer expectations and fierce competition

| Company | Q1 Online Sales Growth | Key Strategy |

|---|---|---|

| Ocado | 12% | Tech Innovation & Expansion |

| JD Sports | 8% | Omnichannel & Exclusive Lines |

Final Thoughts

As these trending tickers continue to capture investor attention, market watchers will be closely monitoring Nvidia’s technological advancements, Trump Media’s evolving narrative, Moderna’s vaccine developments, Ocado’s retail innovations, and JD Sports’ performance amid shifting consumer behaviors. Staying informed on these key players offers valuable insights into broader market dynamics and sector-specific trends shaping today’s financial landscape.