In today’s market roundup, several prominent stocks have captured investor attention, driving notable moves across various sectors. Trending tickers such as Nvidia, Okta, MongoDB, Cracker Barrel, Rio Tinto, and JD Sports are making headlines on uk.finance.yahoo.com, reflecting shifting dynamics in technology, retail, hospitality, and mining. This article delves into the latest developments and trading activity surrounding these companies, providing insights into the factors influencing their market performance.

Trending Ticker Analysis Reveals Market Drivers Behind Nvidia and MongoDB

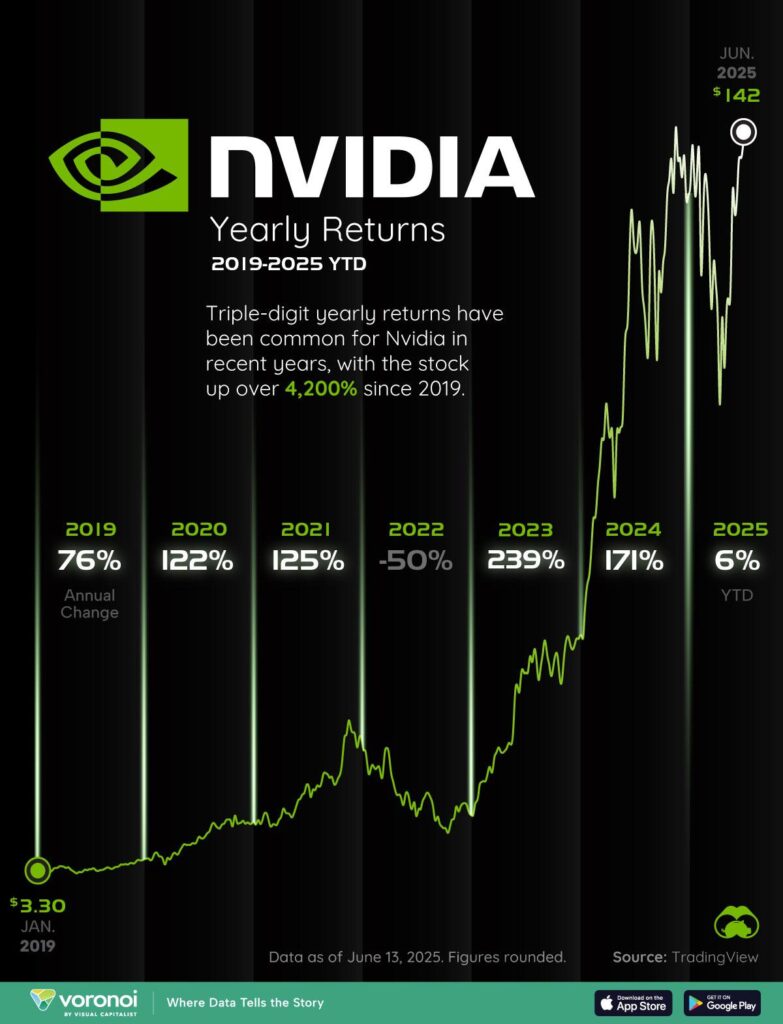

The recent surge in Nvidia‘s stock has been largely driven by growing demand in the artificial intelligence (AI) sector, where the company’s GPUs remain critical for machine learning and data center applications. Investors are also closely watching Nvidia’s strategic partnerships and product launches, which continue to solidify its dominance in the semiconductor industry. Meanwhile, MongoDB benefitted from its robust cloud-native database solutions, capturing attention due to accelerated adoption by enterprise clients aiming to modernize their data infrastructure amid rising digital transformation trends.

Market participants are weighing several factors that fuel these trends, including:

- Strong earnings reports exceeding analyst expectations for both companies.

- Increased cloud computing demand, boosting MongoDB’s recurring revenue streams.

- Expansion into new geographic markets and diversification of product lines.

- Positive industry outlook fueled by AI and big data analytics growth.

| Ticker | Q1 Revenue Growth | Market Cap | Investor Sentiment |

|---|---|---|---|

| Nvidia (NVDA) | +21% | $1.2T | Strong Buy |

| MongoDB (MDB) | +18% | $15B | Buy |

Security Sector Spotlight Highlights Okta’s Strategic Growth Prospects

Okta continues to demonstrate significant momentum in the cybersecurity market, backed by an expanding customer base and robust product innovation. The company’s focus on identity management and secure access solutions positions it at the forefront of tackling rising enterprise security demands amid increasing cyber threats. Recent strategic partnerships and integrations have not only broadened Okta’s ecosystem but also enhanced its appeal to large-scale clients seeking comprehensive, scalable security frameworks.

Market analysts highlight several drivers underpinning Okta’s growth trajectory:

- Cloud migration acceleration: Organizations shifting to cloud infrastructures rely heavily on identity-centric security appliances.

- Zero Trust adoption: Rising adoption of Zero Trust frameworks directly benefits Okta’s core offerings.

- Strong subscription revenue: Recurring revenue streams improve long-term financial visibility.

| Key Metric | Q1 2024 | YoY Growth |

|---|---|---|

| Revenue | $400M | +28% |

| Active Customers | 18,000 | +22% |

| Subscription Renewal Rate | 90% | +3% |

Consumer Retail Focus Examines Cracker Barrel and JD Sports Performance Trends

Cracker Barrel has shown a steady recovery, buoyed by its unique blend of Southern charm and comfort food that resonates strongly with domestic travelers. Recent quarterly reports highlight a rebound in same-store sales, driven by increased foot traffic and a refreshed menu offering. The retailer’s strategic focus on expanding its hospitality services and improving digital ordering platforms has also contributed to its upward trajectory amid a challenging economic backdrop. Market analysts note that Cracker Barrel’s resilience lies in its ability to blend nostalgia with modernization, successfully appealing to both older generations and younger consumers alike.

On the other side of the spectrum, JD Sports continues to leverage its dominance in the athletic fashion market through aggressive international expansion and exclusive product partnerships. The UK-based retailer’s latest performance metrics reveal a robust increase in online sales, which now constitute a significant portion of total revenue. Industry experts emphasize JD Sports’ strong brand portfolio and its agility in adapting to fast-changing consumer trends as key growth drivers. Investors are closely watching how the company capitalizes on emerging markets and integrates cutting-edge e-commerce technology to sustain its momentum.

| Company | Q1 Revenue Growth | Online Sales % | Expansion Focus |

|---|---|---|---|

| Cracker Barrel | +8.5% | 25% | Hospitality services |

| JD Sports | +12.3% | 47% | International markets |

Mining Industry Update Explores Rio Tinto’s Latest Developments and Investment Outlook

Rio Tinto has recently announced a series of strategic developments that are poised to reshape its foothold in the global mining sector. The company is advancing its commitment to sustainability by accelerating investments in green technologies, including low-emission mining equipment and renewable energy integration at its operations. These initiatives not only aim to reduce environmental impact but also position Rio Tinto favorably with ESG-focused investors amid increasing regulatory scrutiny worldwide.

From a financial perspective, Rio Tinto’s outlook reflects cautious optimism. The firm’s robust project pipeline coupled with steady commodity demand supports a positive trajectory despite volatile market conditions. Notably, Rio Tinto’s Q1 earnings showcased resilience, driven largely by strong iron ore sales and cost discipline. Below is a brief overview of key financial metrics and upcoming projects:

| Metric | Q1 2024 | 2023 Full Year |

|---|---|---|

| Revenue (USD Billion) | 14.2 | 55.3 |

| Net Profit (USD Billion) | 3.1 | 12.5 |

| Capital Expenditure | 2.8 Billion | 10.7 Billion |

- Expansion Projects: New copper and lithium mines set to begin construction by late 2024.

- Sustainability Goals: Target to reduce operational carbon emissions by 30% by 2030.

- Market Position: Continued focus on iron ore and diversification into battery metals.

The Way Forward

As these trending tickers continue to capture investor attention, market watchers will be closely monitoring developments from Nvidia, Okta, MongoDB, Cracker Barrel, Rio Tinto, and JD Sports in the coming weeks. Each company faces its own unique set of opportunities and challenges amid evolving economic conditions and sector-specific dynamics. Staying informed on their latest moves will be key for investors aiming to navigate the shifting landscape of global markets.